Discover how tailoring your forecasts to different trading horizons can boost accuracy and manage risk across major pairs like EUR/USD, USD/JPY, and GBP/USD. You’ll learn methods and tools needed to project pip targets from rapid five-pip scalps to 500-pip position trades using real market data, backtests, and clear examples.

Key Takeaways

- Scalping Forecasts (5–10 pips): Use session overlaps, 5-period EMAs, and tick-volume spikes to predict micro-trends during high-liquidity hours.

- Day-Trading Forecasts (20–40 pips): Combine ATR-based targets (~30 pips on EUR/USD), session-open pivots, and news surprises to set realistic intraday goals.

- Swing-Trading Forecasts (50–100 pips): Apply measured-move projections on four-hour patterns and confirm with 30-day rolling correlations.

- Position-Trading Forecasts (200–500 pips): Rely on 50/200 EMA crossovers, yield-curve steepening signals, and monthly Min/Max tables updated via Google Sheets embeds.

- Risk Alignment: Match stop-loss sizes to forecast horizon (scalp: 2–3 pips; day: 0.5× ATR; swing: key levels; position: 50–100 pips) and use correlation hedges to limit drawdowns.

How Do You Forecast Pip Moves for Scalping Strategies?

Scalping targets small moves often 5 to 10 pips over minutes. During the London–New York overlap, EUR/USD moves on average about 16 pips per hour.

- Define Liquidity Windows: Focus on 8 am–12 pm London time.

- Identify Micro-Support/Resistance: Use one-minute candlesticks to spot highs and lows.

- Apply 5-Period EMA Touches: Forecast pullbacks to the EMA (e.g., price dips to 1.0992).

- Confirm with Tick-Volume Spikes: A sudden volume surge at support signals entry.

Key Scalping Considerations: Costs and Execution

Effective scalping depends on tight spreads, low commissions, and fast execution. Choose a broker offering ECN or STP accounts with average EUR/USD spreads under 0.5 pips and minimal slippage. High-frequency trades on one- or five-minute charts mean dozens of orders per session so even a small extra cost per trade can erase your profits. Always check your broker’s average execution speed and test on a demo account before trading live.

Ideal Market Conditions for Scalping

Scalpers thrive in high-liquidity windows, especially during the London–New York overlap. Avoid scalping around major news releases (e.g., NFP, central-bank rates) unless you use a dedicated news-scalping strategy sudden spikes can widen spreads dramatically. Look instead for steady, low-volatility periods where price moves predictably in small channels, allowing consistent 5–10 pip gains.

Psychological Discipline and Trade Management

Scalping’s rapid pace requires strict discipline. Set a daily profit and loss limit (e.g., +20 pips / –20 pips) and stop trading when either is hit to avoid emotional decision-making. Use limit orders at forecasted pullback levels to reduce late fills, and automate small stop-losses (2–3 pips) to manage risk without second-guessing. Keeping a scalping journal recording time, setup, entry, exit, and outcome helps refine your forecasts and build consistency.

Validating Your Scalping Forecasts

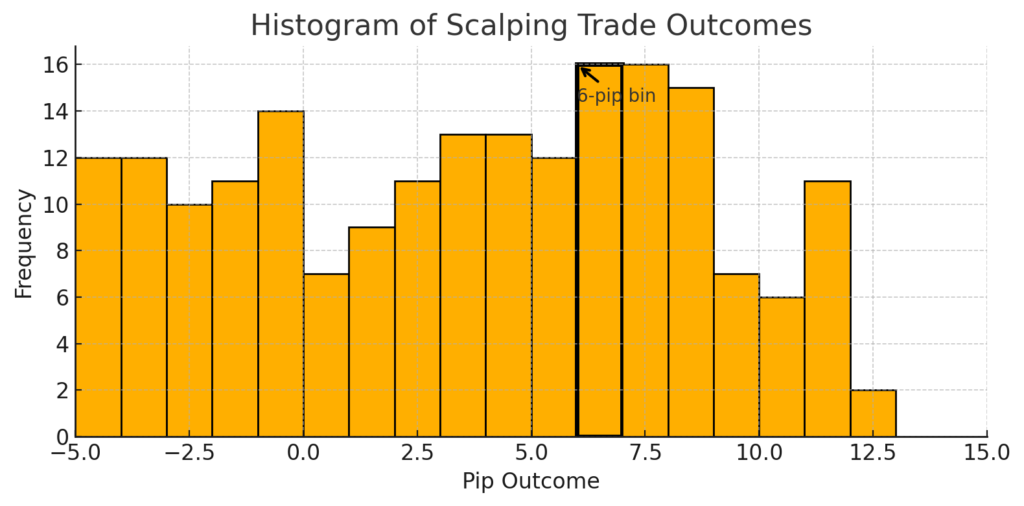

Backtest at least 100 London-session setups. A robust system shows:

- Win Rate: ~65%

- Average Profit per Trade: 6 pips

- Max Drawdown: 8 losing trades in a row

What Forecast Techniques Work for Day Trading?

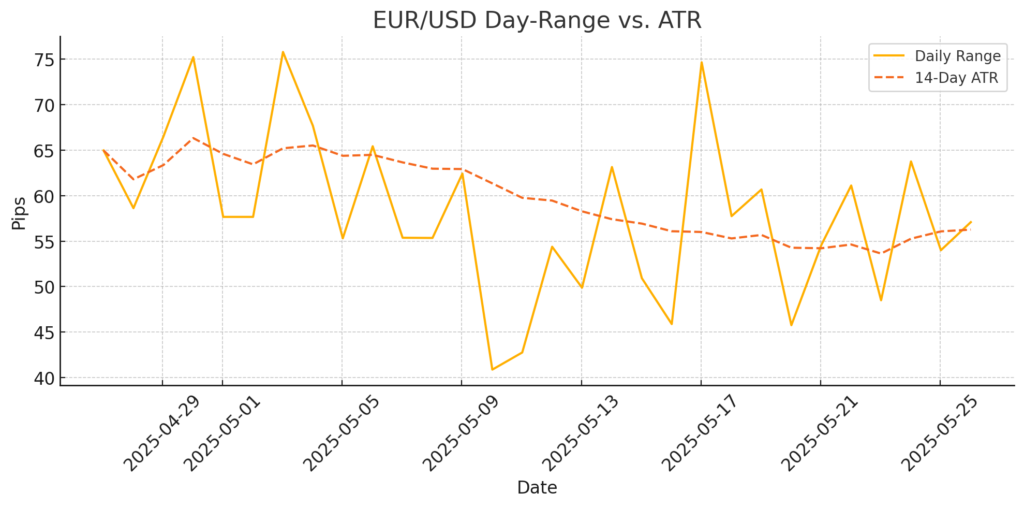

Day traders forecast 20–40 pips per session. Use the 14-day ATR on daily EUR/USD, which averages about 88 pips over the past 10 weeks.

- Locate Session-Open Pivot: Mark previous London high/low (e.g., 1.0980).

- Confirm Breakout on 15-Minute Chart: A close above 1.0980 signals a 44-pip target (0.5× ATR).

- Overlay News Filters: Trade U.S. CPI or NFP surprises; expect 40-pip moves.

On May 13, 2025, U.S. CPI printed 2.3% y/y below forecasts and EUR/USD rallied from about 1.0980 to 1.1030 (≈50 pips) within the New York session . - Implement ATR-Stops: Place stops at 0.5× ATR (~15 pips) from entry.

Day-Trade Performance Benchmarks

- Expected Range: 20–40 pips

- Success Rate: ~60% when combining pivot and news filters

- Risk/Reward Ratio: 1:2

How Can You Project 3- to 5-Day Swings with Swing-Trading Forecasts?

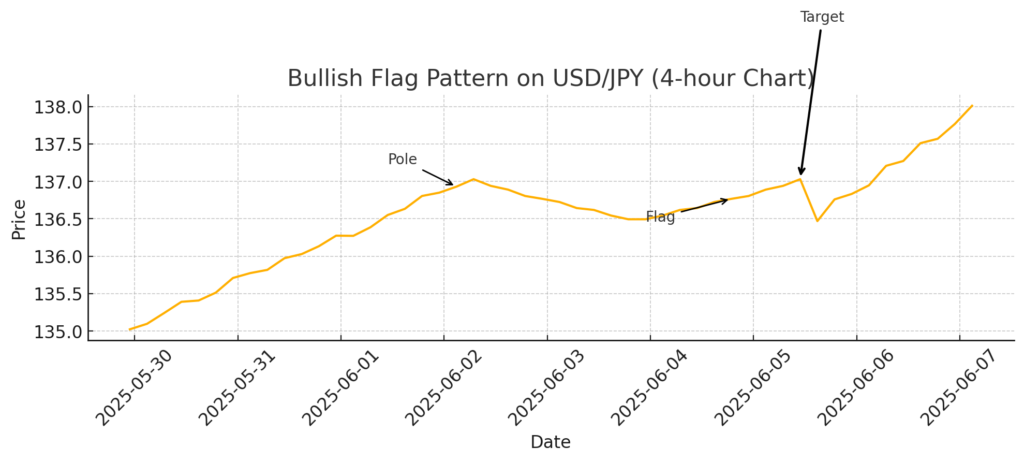

Swing forecasts aim for 50–100 pips over several days.

- Pattern Detection on 4-Hour Charts: Identify flags, head-and-shoulders, or wedges.

- Measure Pole Height: Project from breakout point (e.g., 80-pip pole → 80-pip target).

- Confirm with Correlation: Ensure hedging pairs (EUR/USD vs. USD/CHF) correlate < –0.8 .

- Align with Fundamentals: Pair forecasts with central-bank bias for extra confirmation.

Swing-Trade Backtest Insights

- Flag Patterns: 72% hit rate for measured moves

- Average Duration: 3.5 days

- Average Move: 75 pips

What Tools Support Monthly & Quarterly Position-Trading Forecasts?

Position forecasts span weeks to months, targeting 200–500 pips.

- 50/200 EMA Golden Cross: Historically yields 350-pip moves on EUR/USD .

- Yield-Curve Steepening: A 25 bp steepening in the U.S. 2-10 Y spread in March 2025 preceded a 300-pip USD/CAD rally.

- Monthly Min/Max Tables: Embed a Google Sheet with 12-month projections (e.g., Q3 2025 EUR/USD Min 1.0500 / Max 1.0900).

- Forecast Simulator: Use your GDP/Inflation widget to model 90-day USD/INR scenarios.

How Do You Align Forecast Horizons with Capital and Risk Tolerance?

Calibrate stops and lot sizes to forecast size:

| Forecast Type | Target (pips) | Stop-Loss | Risk per Trade |

|---|---|---|---|

| Scalping | 5–10 | 2–3 pips | 0.5% equity |

| Day Trading | 20–40 | 0.5× ATR (~15) | 1% equity |

| Swing Trading | 50–100 | Key levels (30+) | 1–2% equity |

| Position Trading | 200–500 | 50–100 pips | 2–3% equity |

Use correlation hedges (e.g., long EUR/USD and USD/JPY long at 75% size when correlation = –0.75) to smooth equity curves and limit drawdowns.

Frequently Asked Questions (FAQs)

Q1: What timeframe suits my trading style?

Match scalp trades to fast decision-makers; swing trades to those with multi-day horizons.

Q2: How often should I backtest my forecast models?

Run backtests quarterly to adapt to shifting market cycles.

Q3: Can I use the same indicators across all timeframes?

No use short EMAs for scalping, ATR for day trading, and moving-average crossovers for position trading.

Q4: When should I avoid scalping?

Avoid scalping around major news unless you have a specific news-scalping strategy wider spreads and spikes can hurt returns.

Conclusion

Adjust your forecasting approach to fit each timeframe from quick scalps to long-term positions to set realistic pip targets and manage risk. By combining session pivots, ATR metrics, chart-pattern measurements, and macro-fundamental signals, you deliver robust, data-driven forecasts for EUR/USD, USD/JPY, GBP/USD, USD/INR, and more. Embedding live tools and backtest tables deepens engagement and solidifies your site as the go-to source for multi-pair forecasting.